News

Helping farmers manage financial risk with football metaphor

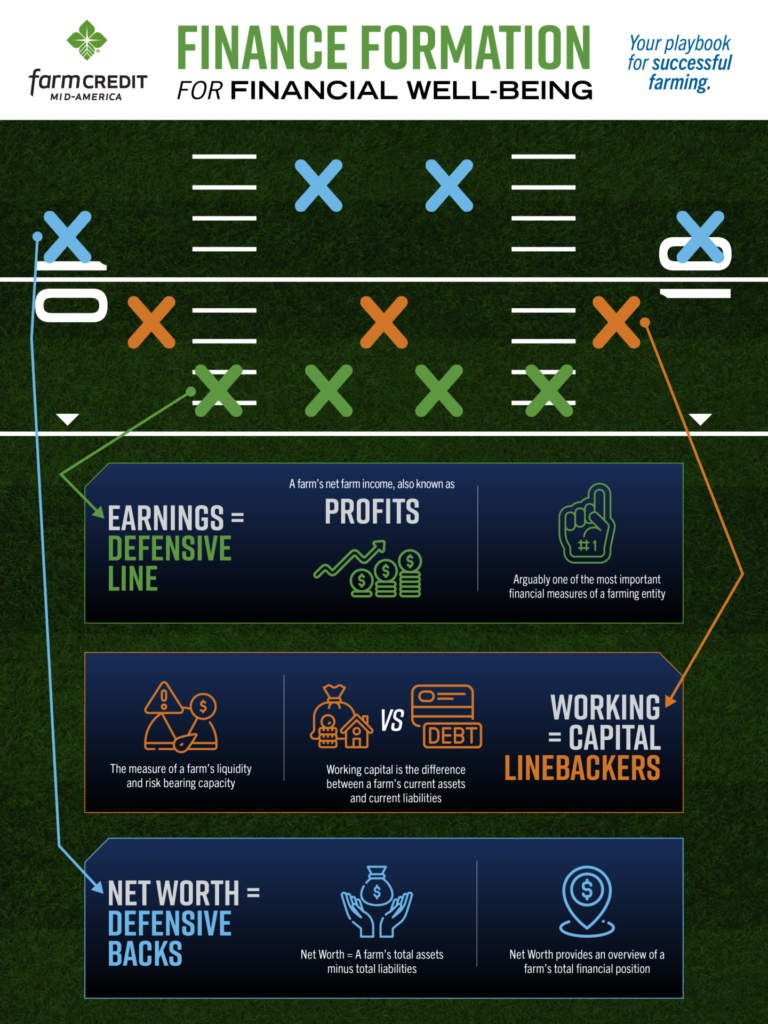

The senior vice president of agricultural lending with Farm Credit Mid-America is using football as a financing metaphor to help farmers manage risk.

Steve Witges says, for example, there are three layers of defense protecting the endzone, a farmer’s financial wellbeing

“You have the defensive line, that first line of defense stopping the opposition from getting into your endzone. I equate that to your earnings within your farming operation,” he says. “So, when we have strong net farm income, that means we have a healthy defensive line.

Witges compares working capital to linebackers.

“When we face times where profits are squeezed, we can find ourselves in a situation where we have to rely on working capital to meet the needs of the farming operation. Linebackers, the second line of defense in football, are comparable to the working capital in a balance sheet. If profits are squeezed, we’re not making enough money to meet debt payments etc. and we have a cash flow shortage, a lender is going to want to see what kind of working capital that farming operation has to still meet obligations during more difficult times where profitability isn’t as strong. If you have a good, strong linebacker and working capital, if they get through the defensive line, they still can stop the other team from getting into your endzone.”

He tells Brownfield, “the third layer is your defensive backs. If your earnings are weak and your working capital has been depleted, the defensive backs and final line of defense is your overall net worth. I’ve been in this business for over 35 years, and I’ve seen the ups and downs. At some point in time when earnings aren’t there and working capital has been depleted, I’ve seen people have to restructure debt and maybe have to sell assets to make ends meet. When you do that, you’re digging into overall net worth.”

Witges is helping farmers manage their finances and mitigate risk with a “Finance Formation” playbook.

“Defense should be part of our strategy. That doesn’t mean we cower down and never do anything or invest, but we’re very aware of the current financial times we’re in. There’s an old saying: it’s what you do during the good times that prepares you for the bad times. And so, I think preparing for the more difficult times is being very diligent in how we manage our finances during good times. We’re still expecting fairly good profits this year. When that happens, farmers have additional working capital. I hope the analogy brings to light the importance of balancing all of these things and maintaining or having a working capital plan. I hope it also brings awareness to the importance of understanding the impact of earnings, whether they’re good or bad, on the overall financial position and financial wellbeing of a farming operation.”

Witges has more than three decades of experience in agricultural credit.

Audio: Steve Witges

Click here for more information.

Add Comment