News

Farm bankruptcies reach decade-high levels

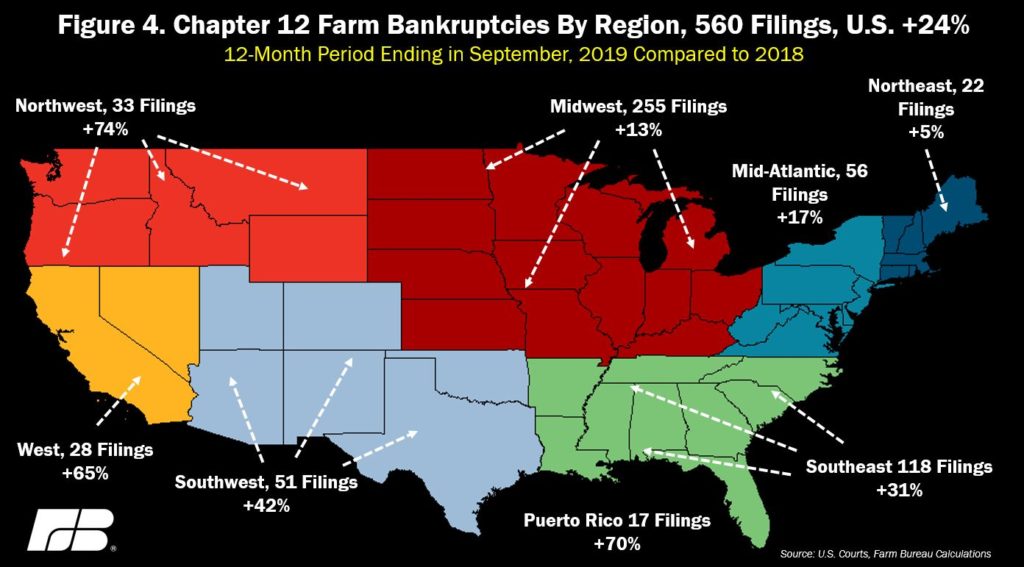

New data from the US Courts shows chapter 12 farm bankruptcies increased 24% in the 12-month period ending September 2019.

American Farm Bureau economist John Newton tells Brownfield there were 580 total filings with 255 in the Midwest – up 13% from year ago levels.

“I think it really signals the financial stress that we have experienced in the farm economy now for several years. We look for the trade aid and crop insurance benefits to hopefully reverse this trend soon.”

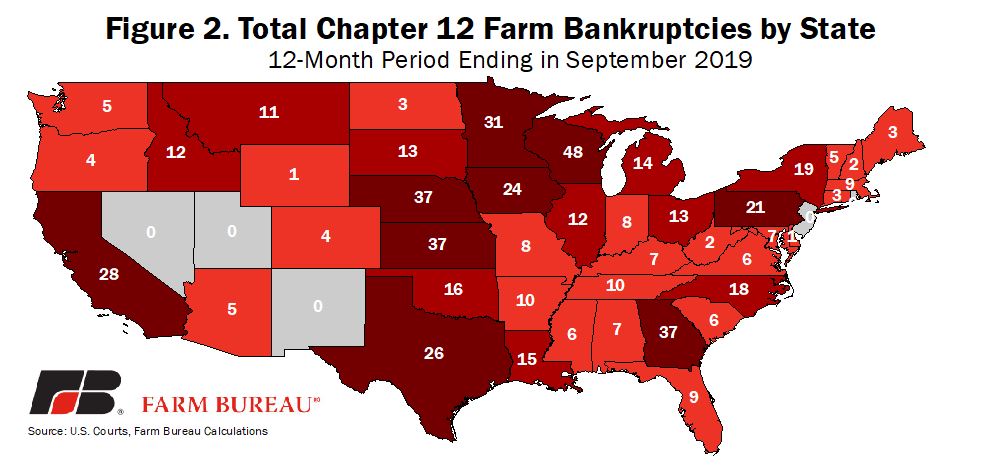

Newton says a notable Midwest state is Wisconsin with 48 filings – the highest in the last decade.

“We’ve seen the number of dairy farms that Wisconsin has lost accelerate in recent years and that really coincides with what we are seeing on the bankruptcy front.”

Newton says bankruptcies have been going uphill for a while and have not been this high since 2011, but are nowhere near the level of the 1980’s.

“We have historically low interest rates and the repayment maturity terms are at record highs, so farmers are finding more ways to stretch out that repayment period.”

When looking at the 3rd quarter of 2019, Newton says bankruptcies are starting to stabilize which he calls a glimmer of hope.

The number of chapter 12 bankruptcies in Brownfield states for this 12-month period include: Missouri – 8; Arkansas – 10; Illinois – 12; Tennessee – 10; Michigan – 14; Indiana – 8; Ohio – 13.

The following Brownfield states are at or above their 10-year high for number of bankruptcies in this period: South Dakota – 13; Nebraska – 37; Minnesota – 31; Iowa – 24; Wisconsin – 48.

Add Comment