News

CME begins block cheese futures and options trading Sunday

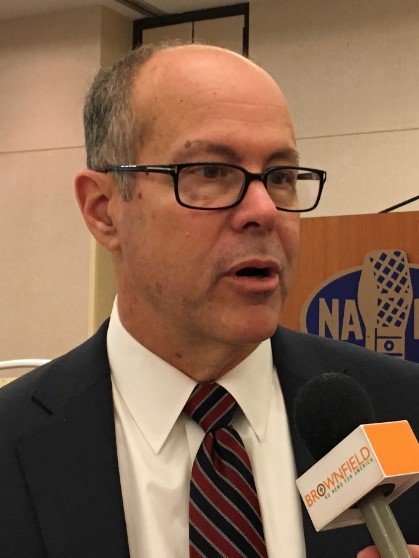

The Chicago Mercantile Exchange will now offer block cheese futures and options trading because of high customer interest. Tim Andriesen is CME’s Managing Director of Agricultural Products, and says, “In response to those customers, we decided to launch a cash-settled contract which settles to the monthly average of the 40-pound block cheddar cheese as reported by the USDA.”

Andriesen tells Brownfield many customers wanted to manage block cheese risk independent of the broader cheese contracts. “It’s a tougher market because it’s not quite as clear and simple as say, managing the risk around grains but we think that there’s a lot more opportunity for people to manage risk but I think you’re still going to continue to see the same trades happen in the physical market.”

Andriesen says as far as cheese volumes, he predicts both the cash market and the futures market will see considerable trading activity.

He says brokers can access the new market this weekend. “The contract will actually be available to trade starting Sunday night, which is January 12th, but you’ll see most of the trades start up on Monday, January 13th.”

Andriesen says the push towards offering block futures and options started picking up steam about nine months ago.

Add Comment